A Few of Today's Reads (Thursday, June 26, 2025)

The Great Hollywood Exodus / The SPAC Resurgence in 2025

What's Happening Today: Thursday, Awal Mouharam, Madagascar Independence Day & Ras el-Am el-Hijri expected earnings from Acuity Brands, Walgreens, McCormick&Co and Nike

• EXCLUSIVE - The Great Hollywood Exodus / Why the Film Industry Is Abandoning LA: Los Angeles in 2025 feels like a faded movie star clinging to past glory. The Hollywood sign looms over a city where soundstages are half-empty, their occupancy rates slipping to 63% in 2024 from 69% in 2023. On-location shoot days have nosedived, down 22.4% in Q1 2025 to a mere 5,295, with 2024 ranking as the second-lowest production year since FilmLA began tracking in 2017. (Ken Rutkowski)

• Central Banks Warn Stablecoins Threaten Global Financial Stability: The Bank for International Settlements (BIS) cautions that stablecoins, despite their $156 billion market surge, fail as reliable money due to risks like capital flight and illegal use. The report urges tighter regulations to curb these digital currencies’ potential to destabilize economies, favoring tokenized central bank systems instead. (Qz)

• Magnetic Levitation Hunts Elusive Ultralight Dark Matter: Rice University scientists deployed a magnetic levitation sensor, detecting movements smaller than a hydrogen atom, to search for ultralight dark matter’s rhythmic forces. “Every time we don’t find dark matter, we refine the map,” says physicist Christopher Tunnell, narrowing future cosmic quests. (The Debrief)

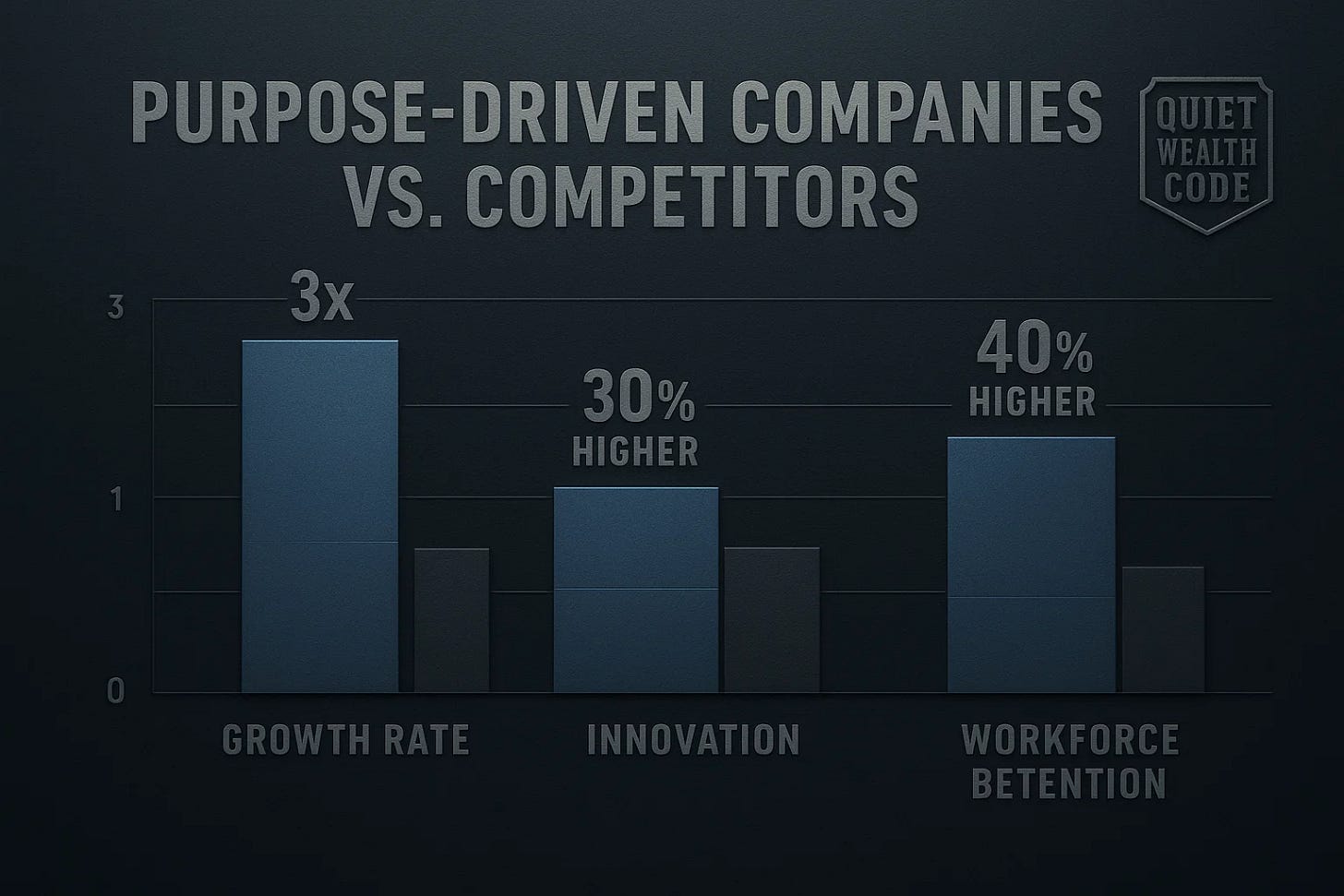

• The Quiet Wealth Code: How Titans Build Empires with Purpose and Precision: Wealth isn’t the endgame; it’s the resource. Money buys freedom—freedom to chase your purpose, to say no, to build what matters. In a 2024 G2 study, 66% of consumers feel connected to brands that earn their trust, not those flashing logos. Apple doesn’t sell you a phone; it sells you a lifestyle of simplicity and innovation. (Command & Scale)

• Astronomers Discover Quipu, Universe’s Largest Cosmic Structure: Astronomers have unveiled Quipu, a colossal cosmic structure stretching 1.3 billion light-years, containing 200 quadrillion solar masses. “Quipu is readily noticeable by eye in a sky map,” researchers note, reshaping our understanding of galaxy evolution and cosmic expansion. (The Brighterside)

• Evolution of Reason Challenges Belief in Evolution: Philosophers question if reason, shaped by evolution for survival, can reliably uncover truth, including evolution itself. Neuroscientist Antonio Damasio argues, “Reason may not be as pure as most of us think,” sparking debate about whether our minds prioritize utility over absolute truth. (Big Think)

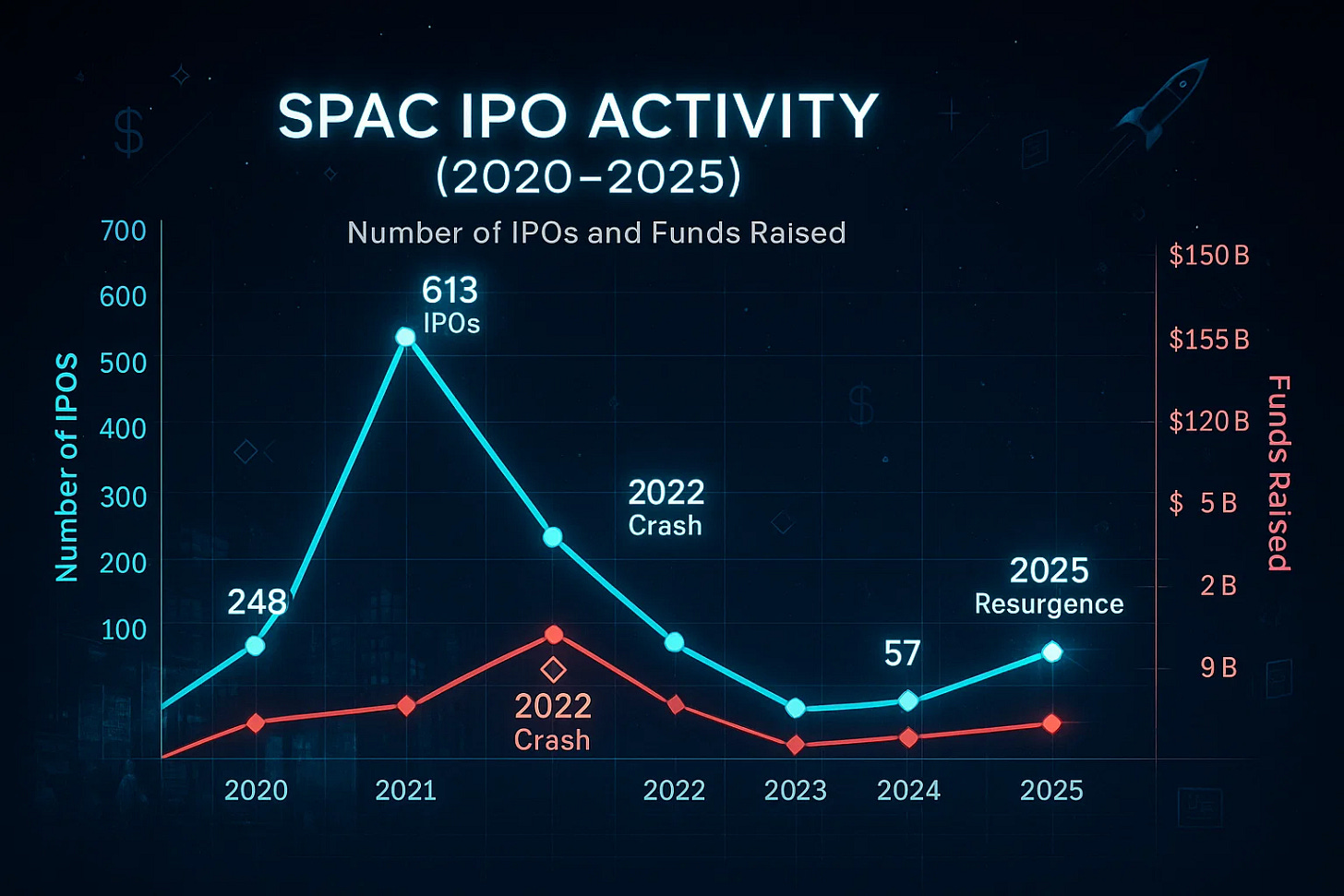

• EXCLUSIVE - The SPAC Resurgence in 2025 / A High-Stakes Gamble for the Future of Finance: Imagine a financial vehicle that promises to catapult startups into the public markets with the speed of a SpaceX rocket, bypassing the grueling marathon of a traditional IPO. Now picture it as a blank check, handed to a charismatic sponsor who’s part Warren Buffett, part Elon Musk, with the power to merge it with the next Tesla—or the next Theranos. (Ken Rutkowski)

• Ancient DNA Unveils Female-Centered Prehistoric Society: DNA from a 2,000-year-old Dorset cemetery reveals a Celtic Durotriges tribe where women held central roles, with 57 genomes showing matrilocal bonds. “This was a clear signature of matrilocality,” says geneticist Lara Cassidy, hinting at empowered women shaping Iron Age Britain’s social fabric. (404)

• Ancient Viral Genes Linked to Alzheimer’s, ALS: Retrotransposons, ancient viral genes comprising 40% of our genome, may drive Alzheimer’s and ALS by sparking inflammation and nerve cell damage. “They’re making factors that look like a virus to the cell,” says neurobiologist Bess Frost, as trials test HIV drugs to curb these rogue genes. (Knowable Magazine)

• Oceania Tops Global Cocaine Use, UN Report Reveals: Australia and New Zealand lead the world in per-capita cocaine use, surpassing the Americas, according to the UN’s World Drug Report cited by Statista. This surprising shift highlights a growing drug challenge in Oceania, sparking questions about cultural and economic drivers behind the trend. (Statista)

• Cannabis Seeds Soar to Space for Cosmic Crop Study: Last week, 150 cannabis seeds launched aboard a SpaceX Falcon 9 to test their resilience in high-radiation polar orbit. “Cannabis is the ideal plant for lunar bases,” says researcher Božidar Radišič, sparking intrigue about its potential as a versatile space crop. (Wired)

• Dead NASA Satellite Emits Mysterious Radio Burst: A defunct NASA satellite, Relay 2, dormant since 1967, unleashed a surprising radio burst detected by Australia’s ASKAP telescope on June 13, 2024. Likely caused by an electrostatic discharge, this “nanosecond signal” at 4,500 kilometers from Earth underscores the hidden hazards of space junk. (ScienceAlert)

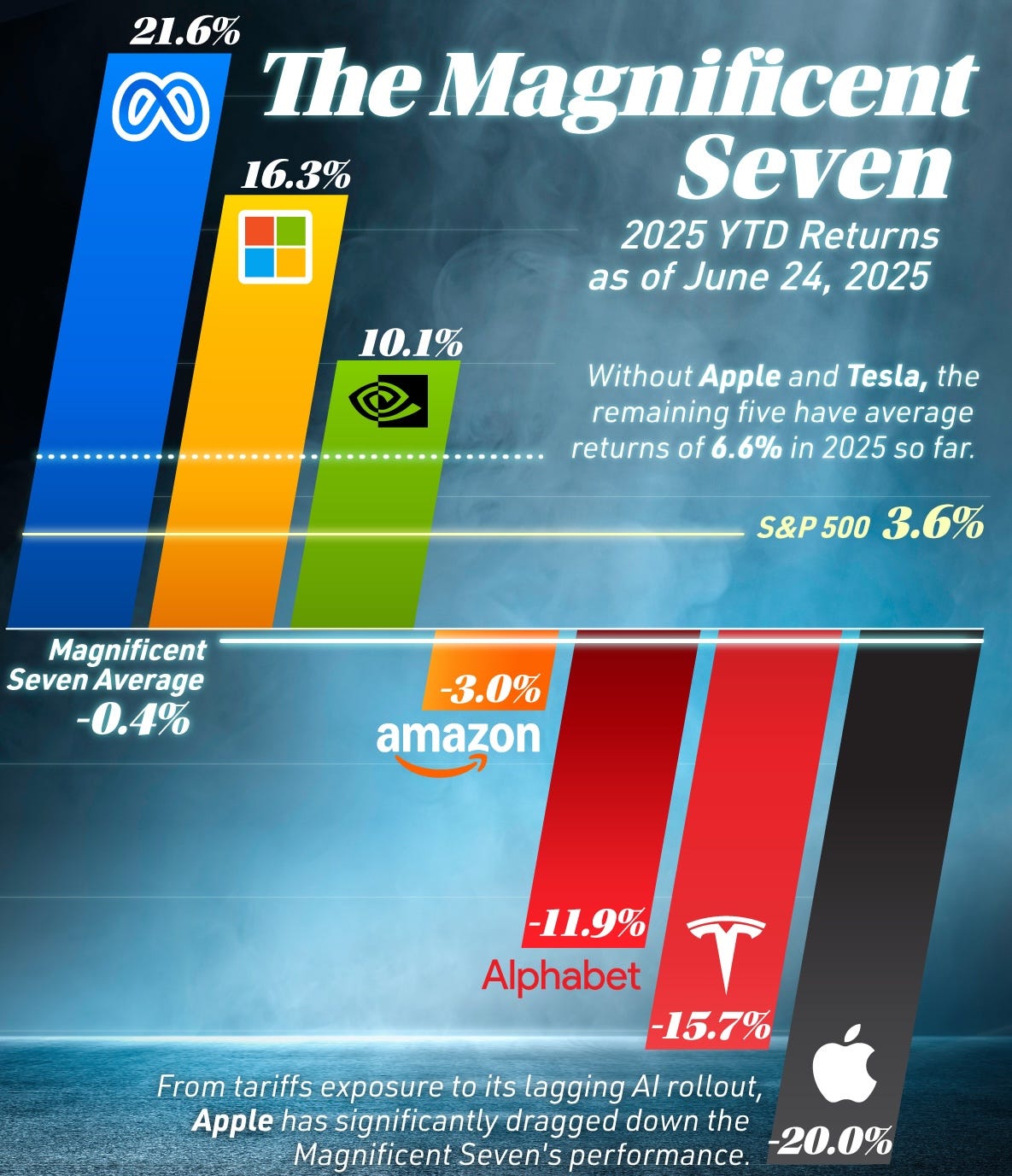

• 2025 Predictions Update Reveals Hits and Misses: Visual Capitalist’s midyear review confirms experts’ foresight on European market surges, with Germany’s DAX 40 climbing 13.2%, outpacing U.S. indices. However, ambitious federal spending cuts stalled against a projected $7 trillion budget, underscoring persistent economic challenges in 2025. (Visualcapitalist)

• Coffee Culture Transforms Hotels into Vibrant Community Hubs: Hotels are revolutionizing their coffee offerings, partnering with local roasters and creating lively lobby cafes, with Gleneagles Hotel serving 600-700 cups daily during breakfast. “Coffee has become a touchpoint for wellness, sustainability, and storytelling,” says Fernando Cruz, reflecting a shift toward curated, community-driven experiences. (Roadbook)

• Koenigsegg’s Sadair’s Spear Unleashes Track-Dominating Power: Koenigsegg’s Sadair’s Spear, a ferocious Jesko variant, boasts 1,625 horsepower on E85 and shaves 77 pounds, slashing 1.1 seconds off the Jesko Attack’s Gotland Ring lap time. This street-legal hypercar, named after a racehorse, sold out its 30-unit run instantly, cementing its elite status. (Motor1)

• Amazon Tightens Grip on Whole Foods with Deeper Integration: Eight years after its $13.7 billion acquisition, Amazon is streamlining Whole Foods’ operations under its “One Grocery” plan, aligning corporate staff with Amazon’s systems. Despite this, Whole Foods holds just 1.6% of the U.S. grocery market, trailing Walmart’s 21.2%, as competitors bolster e-commerce. (Chartr)

• Ancient Mammoth Tusk Boomerang Rewrites Toolmaking History: A 40,000-year-old mammoth ivory boomerang from Poland’s Obłazowa Cave, likely carved between 42,365 and 39,355 years ago, is Europe’s oldest and possibly the world’s earliest. “Its arched shape matches modern Aboriginal boomerangs,” revealing early Homo sapiens’ advanced craftsmanship. (LiveScience)

• Dubai’s Hidden Past as British India’s Outpost: In the early 20th century, nearly a third of the Arabian Peninsula, including Dubai, was governed from Delhi as part of British India. A quiet 1947 decision severed these ties, leaving echoes of an era when Indian passports reached Yemen and Gulf states were princely outposts. (BBC)

• Sleep Startups Snag Millions in Venture Capital Surge: Venture capitalists are pouring hundreds of millions into sleep-focused startups, with Oura raising $200 million for its sleep-tracking rings. As poor sleep leaves over half of adults unhappy, per the National Sleep Foundation, these firms aim to revolutionize rest with innovative tech and apnea treatments. (Crunchbase)

• AI Browser Wars Ignite with Dia’s Bold Launch: The Browser Company’s Dia, an AI-first browser, challenges Chrome’s dominance by seamlessly integrating AI to query open tabs, leaving Arc in maintenance mode. “Dia is essentially Chrome + AI,” writes M.G. Siegler, signaling a new era where browsers like Perplexity’s Comet and OpenAI’s rumored project vie for supremacy. (Spyglass)

• Today's Photo, Image, or Video of the Day: When Star Wars began airing on television in 2003, Chile stitched the commercials into the films themselves to avoid cutting to commercial breaks.

• Notable Statistic: World leaders were once

• YouTube Worth Watching: The Most Expensive Food in the World; Ina Garten; Pasta Pavarotti

• Ken's Book Pick: Salt, Fat, Acid, Heat: Mastering the Elements of Good Cooking

• Ken's Website / Tool: Roop Unleashed is a free online face swap tool for photos and videos. Swap multiple faces with smart controls, simple UI, and fast processing.

Return on Investment (ROI) for College Degrees

This report analyzes the return on investment (ROI) for various college degrees based on data reflecting earnings after five years in the workforce. The ROI is calculated as a percentage of the median wage earned after five years relative to the average cost of college ($135,800 over four years). The data is derived from the top popular degree types based on the equivalent field of degree data from the BLS (Bureau of Labor Statistics) as of 2024, with several majors combined into one degree type where applicable.

Key Findings

Top ROI Degrees (Wheel Chart)

The wheel chart visually represents the ROI percentage and median annual earnings after five years for the most popular college degrees. The top degrees by ROI include:

Engineering: 326.6% ROI, $145,000 median annual earnings

Computer Science & Information Technology: 310.3% ROI, $141,500 median annual earnings

Nursing: 290.0% ROI, $132,000 median annual earnings

Accounting: 264.0% ROI, $120,200 median annual earnings

Biochemistry: 238.0% ROI, $108,400 median annual earnings

Business: 224.0% ROI, $102,000 median annual earnings

Other notable degrees with strong ROI include:

Social Work: 163.3% ROI, $74,300 median annual earnings

Education: 156.0% ROI, $71,000 median annual earnings

Exercise Science: 148.0% ROI, $67,400 median annual earnings

Psychology: 136.0% ROI, $62,000 median annual earnings

Degrees with lower ROI include:

Communications: 112.3% ROI, $51,100 median annual earnings

History: 106.0% ROI, $48,300 median annual earnings

Criminal Justice: 100.0% ROI, $45,500 median annual earnings

ROI for Common Occupations Requiring a Bachelor's Degree

The bar chart details the ROI, median annual wage, total median wage after five years, and rank for common entry-level positions requiring a bachelor's degree. The top 10 positions by ROI are:

Computer and Information Systems Manager: 553.7% ROI, $251,700 median annual wage, $1,258,500 total median wage

Advertising, Promotions, and Marketing Manager: 511.4% ROI, $232,600 median annual wage, $1,163,000 total median wage

Aerospace Engineer: 472.6% ROI, $215,000 median annual wage, $1,075,000 total median wage

Software Developer, Quality Assurance, and Tester: 425.2% ROI, $193,400 median annual wage, $967,000 total median wage

Financial Analyst: 363.1% ROI, $165,100 median annual wage, $825,500 total median wage

Management Analyst: 347.9% ROI, $158,300 median annual wage, $791,500 total median wage

Medical and Health Services Manager: 331.6% ROI, $150,800 median annual wage, $754,000 total median wage

Art Director: 329.2% ROI, $149,700 median annual wage, $748,500 total median wage

Mechanical Engineer: 325.0% ROI, $147,800 median annual wage, $739,000 total median wage

Civil Engineer: 313.2% ROI, $142,400 median annual wage, $712,000 total median wage

Other positions with varying ROI include:

Registered Nurse: 284.3% ROI, $129,400 median annual wage, $647,000 total median wage

Accountant and Auditor: 260.9% ROI, $118,700 median annual wage, $593,500 total median wage

Social and Community Service Manager: 249.5% ROI, $113,500 median annual wage, $567,500 total median wage

Elementary School Teacher: 211.0% ROI, $96,000 median annual wage, $480,000 total median wage

Probation Officer and Correctional Treatment Specialist: 191.9% ROI, $87,300 median annual wage, $436,500 total median wage

Agricultural and Food Scientist: 150.0% ROI, $68,200 median annual wage, $341,000 total median wage

Analysis

High ROI Fields: Degrees in STEM (Science, Technology, Engineering, and Mathematics) and healthcare (e.g., Engineering, Computer Science, Nursing) consistently show the highest ROI, often exceeding 300%. This is attributed to high demand and lucrative salaries in these sectors.

Moderate ROI Fields: Business, Accounting, and Biochemistry offer solid returns (200-300% ROI), reflecting a balance between cost and earning potential.

Lower ROI Fields: Degrees in humanities and social sciences (e.g., Communications, History, Criminal Justice) have ROI closer to or just above 100%, indicating a longer time to recover the initial investment.

Occupational ROI: Management and technical roles (e.g., Computer and Information Systems Manager, Aerospace Engineer) yield the highest ROI due to significant salary growth over five years, while teaching and social service roles offer lower but stable returns.

Conclusion

Investing in a college degree can yield significant returns, particularly in STEM and healthcare fields, where ROI can exceed 300% within five years. However, the choice of degree and subsequent career path significantly impacts the financial outcome. Prospective students should consider both their interests and the earning potential associated with their field of study.