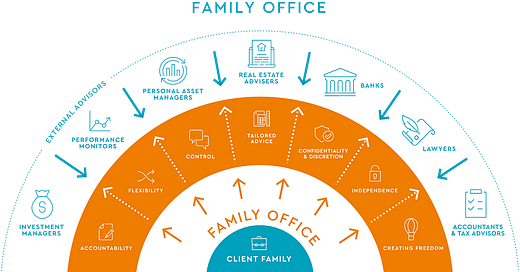

The guarded universe of family offices—opaque by design, reserved for the ultra-wealthy, and generally off-limits to outsiders. But in 2024, the veil has been lifted, if only slightly, to reveal a fascinating trend: family offices are diving headfirst into the startup world, funding the next wave of technological and societal breakthroughs. Here’s why f…

Keep reading with a 7-day free trial

Subscribe to The Most Important News to keep reading this post and get 7 days of free access to the full post archives.