The Retail Investor Revolution: How "Dumb Money" Got Smart

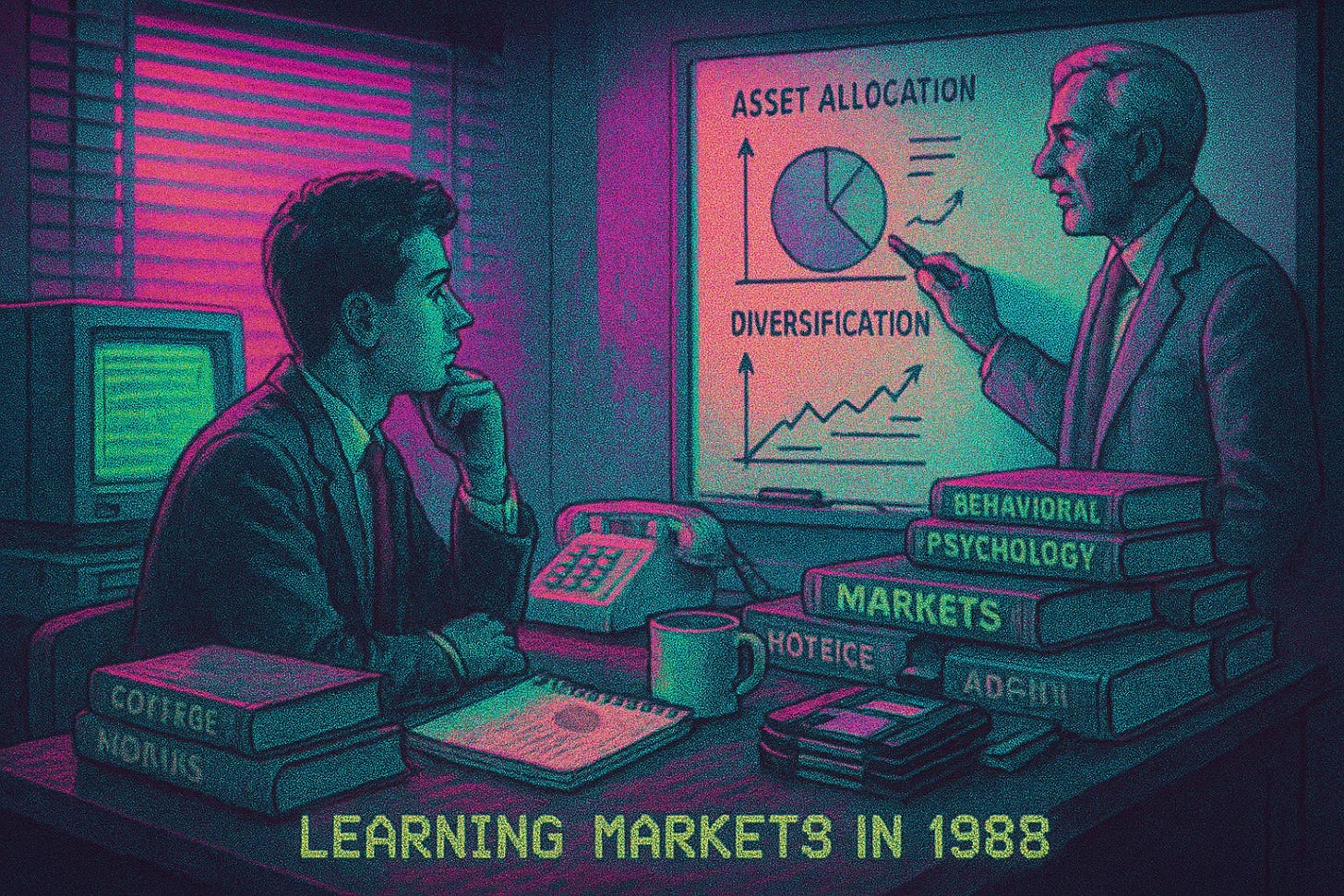

Back in 1988, leaving college and stepping into my first job, I had some textbook knowledge but was completely clueless about how markets, people, incentives, or investing actually worked. There were no podcasts, no YouTube finance gurus, no Twitter threads breaking down market dynamics in real-time. My education came from dog-eared books on behavioral psychology and markets, relentless questioning, and the occasional whiteboard session with my patient boss. He’d sketch out the basics—asset allocation, diversification, client communication—while I scrambled to keep up. It took years to feel like I had a grip on anything substantial.

Investing itself was a slog back then. High minimums, steep fees, no zero-commission trades, and a maze of legacy financial firms made it feel like the system was built to keep newbies out. Fast-forward to today, and the landscape is unrecognizable. Barriers to entry have crumbled. You can open an account on your iPhone, buy fractional shares of Apple or Tesla in minutes, and access a firehose of financial wisdom from newsletters, Reddit, and TikTok. For decades, the mantra has been drilled into us: think long-term, don’t time the market, and stay calm. And guess what? It’s working.

The old stereotype of retail investors—panicky amateurs who buy high and sell low—is dead. The “dumb money” isn’t so dumb anymore.

Keep reading with a 7-day free trial

Subscribe to The Most Important News to keep reading this post and get 7 days of free access to the full post archives.